Do you rent an office or a commercial space for your business here in Davao?

In this case, you have the obligation to withhold rent payment. The percentage of withholding tax is 5%. During the rental payment, you will pay the landlord / lessor the agreed amount minus 5% for the withholding tax. Instead of giving the full amount, you are going to give your lessor the 2307 form or also known as Certificate of Creditable Tax Withheld At Source as proof that you are going to remit that withheld amount to the BIR.

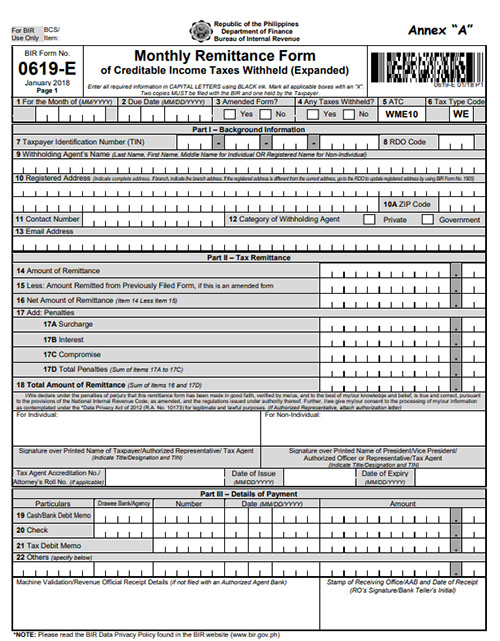

The form to be filled in is the BIR 0619E form for the Monthly Remittance and 0619EQ for Quarterly Remittance of Creditable Income Taxes Withheld. You can download the form in your eBIRForms. If you find this process difficult, you may want to ask for help from your bookkeeper or accountant.

So, when is the due date of this payment?

For the monthly (0619E) , the due date is on or before 10th of the following month.

For the quarter (0619EQ), the due date is every last day of the following month after each quarter.

For example:

Month of JANUARY – Due Date: February 10 (Form 0619E)

Month of FEBRUARY – Due Date: March 10 (Form 0619E)

Month of MARCH – Due Date: April 30 (Form 1601EQ)

Month of APRIL – Due Date: May 10 (Form 0619E)

Month of MAY – Due Date: June 10 (Form 0619E)

Month of JUNE – Due Date: July 30 (Form 1601EQ)

Month of JULY – Due Date: August 10 (Form 0619E)

Month of AUGUST – Due Date: September 10 (Form 0619E)

Month of SEPTEMBER – Due Date: October 30 (Form 1601EQ)

Month of OCTOBER – Due Date: Nov 10 (Form 0619E)

Month of NOVEMBER- Due Date: December 10 (Form 0619E)

Month of DECEMBER – Due Date: January 30 (Form 1601EQ)

Also, do not forget to submit 1604E known as summary of all your payments on or before March 1 of the following year.

Feel free to comment or share your inputs, let’s help each other learn about our government’s obligation to avoid penalties …

#DavaoBlog.com